Top 10 Medical Billing Errors CMAAs Must Avoid

For Certified Medical Administrative Assistants (CMAAs), medical billing isn’t just a backend task—it’s a frontline responsibility that starts the moment a patient checks in. The accuracy of what happens at the front desk directly affects the entire revenue cycle. One wrong digit in a date of birth, an unchecked insurance policy, or a missing prior authorization can snowball into denials, lost revenue, and compliance risk. That’s why mastering workflow and data entry precision is essential—even the basics can cost your clinic thousands if skipped.

This guide breaks down the 10 most frequent medical billing errors CMAAs must learn to prevent, with each section rooted in real-world software workflows, code requirements, and intake protocols used across today’s medical practices. Whether you're new to billing or refining your front-desk skill set, these insights will keep your claims clean—and your clinic running smoothly.

1. Missing or Incorrect Patient Information

The Front Desk Is Where Billing Begins

The most common cause of denied claims isn’t complex coding—it’s basic patient data errors. A wrong date of birth, a missing subscriber ID, or a typo in the name field can result in immediate rejection by payers. As a CMAA, your job begins at intake and registration, where the foundation of billing accuracy is laid.

Everything from insurance card entry to spelling and demographics must be verified on the spot. Even one mismatched character between what’s in your EMR and what’s on file with the insurer can cause denials.

One of the best ways to improve accuracy is to follow a structured intake process, using checklists and verification prompts built into your billing software. Here’s a clear, visual reference guide designed to help CMAAs understand where each piece of information fits into the claim lifecycle and how to avoid invalid submissions.

1. Missing or Incorrect Patient Information

The most common claim denials start with intake. A single typo—like a wrong date of birth or subscriber ID—can stop reimbursement cold.

CMAAs set the tone for billing accuracy. Every detail entered during registration must match the insurer’s file exactly. That includes names, numbers, and demographics.

Structured intake checklists and EMR verification prompts help reduce errors from the start, protecting revenue and saving time later.

2. Failing to Verify Insurance Eligibility

It’s Not Enough to Copy a Card

One of the costliest assumptions front-desk staff make is believing that an insurance card equals active coverage. Eligibility must be verified in real-time, either through clearinghouses or directly within the EMR system. This step helps prevent rejected claims and ensures the correct payer and plan are billed the first time.

Verifying eligibility includes checking coverage dates, copays, deductibles, and service restrictions. It also reveals whether the patient has a secondary insurer, what pre-auths may be required, and whether the provider is in-network.

As a CMAA, you must master tools that let you check this directly from the EMR interface. This EMR data entry guide breaks down how to document these verifications clearly—reducing the risk of rework for the billing department and ensuring a smoother patient experience from day one.

3. Using Outdated Codes

ICD-10, CPT, and HCPCS Updates

Even when every patient detail is accurate, claims can be instantly denied if outdated codes are used. CMAAs must stay current with ICD-10, CPT, and HCPCS updates, which change annually and sometimes quarterly. These updates reflect new medical procedures, diagnoses, and billing rules.

The issue arises when clinics forget to sync updates into their practice management system—or when staff don’t double-check code validity. CMAAs can prevent costly mistakes by flagging codes during pre-submission checks and using billing software that includes auto-updated libraries.

Mastering terminology is key. Understanding the difference between a diagnosis code and a procedure code helps CMAAs spot mismatches early. This 2025 administrative glossary covers the exact terms, modifiers, and code categories CMAAs need to know cold—whether working in family practice or specialty care.

| Issue | Impact on Billing | How CMAAs Can Prevent It |

|---|---|---|

| Outdated ICD-10, CPT, or HCPCS codes | Automatic claim denials by payers due to invalid code entries | Use billing software with auto-updated code libraries |

| Failure to sync new code sets into PM systems | Delayed reimbursements and rework of rejected claims | Coordinate quarterly code updates with the IT or billing lead |

| Confusion between diagnosis and procedure codes | Code mismatches that trigger denials or audits | Review administrative glossaries and attend coding update trainings |

4. Forgetting Modifiers

Small Add-Ons, Big Consequences

Modifiers may seem like small code additions, but they hold big meaning. A missing modifier can result in a claim being underpaid or denied, especially when multiple procedures are performed in one visit. CMAAs are often the first to catch modifier red flags—especially when reviewing encounter forms or superbills.

Knowing when a procedure needs clarification (like distinguishing left vs. right side) is vital. Many CMAAs mistakenly assume modifiers are the coder’s job, but they actually appear during intake and encounter entry—areas CMAAs often handle.

To improve accuracy, CMAAs should use practice-specific modifier cheat sheets and cross-reference them before submission. This core CMAA term guide offers clear definitions and use cases for the most common modifiers, plus insider tips on how to spot when one might be missing.

4. Forgetting Modifiers

Modifiers may be short, but they carry weight. When they’re left off, claims are denied or underpaid—especially for multi-procedure visits.

CMAAs must know when clarification is needed—like left vs. right, repeat procedures, or bundled services. These details surface at intake and encounter entry, not just during coding.

Practice-specific modifier cheat sheets help prevent errors. Cross-check every entry, especially on superbills. The included CMAA term guide breaks down the most-used modifiers with simple, real-world use cases.

5. Incorrect Provider Information

NPI, Tax ID, and Credentialing Errors

Claims are often denied simply because provider information is incorrect—even when everything else is accurate. The National Provider Identifier (NPI), Tax ID, and credentialing details must exactly match payer records. A single typo in a provider’s name or a mismatch in group vs. individual billing can delay payment for weeks.

CMAAs can prevent this by double-checking EMR templates and ensuring provider credentials are current and properly linked to the correct locations and insurances. Most front desks collect this information during setup and maintain it over time, but errors slip through when templates are cloned or copied.

CMAAs should also routinely audit provider data against clearinghouse rejections and flag any inconsistencies to billing leads. One smart way to stay on top of this is to use software with built-in alerts for credentialing expirations—tools you’ll explore in detail within interactive billing software tutorials.

Quick Poll: Which Provider Info Error Have You Encountered Most?

6. Duplicate Billing

Watch Out for Repeat Charges

Duplicate billing happens when multiple claims are submitted for the same service, often due to miscommunication or rushing through batch submissions. It damages provider trust, inflates patient balances, and leads to compliance scrutiny.

CMAAs are the frontline defense here. By carefully reviewing encounter reports and monitoring the billing queue before submission, they can catch repeats. Using integrated EMR-billing systems that highlight already-submitted visits helps prevent accidental resubmission.

To stay sharp, CMAAs must understand what flags duplicate billing in each system—such as patient ID + date of service + procedure code combos. These EMR tutorial tools walk CMAAs through how to check for duplicates and streamline batch claim accuracy.

7. Misunderstanding Coordination of Benefits

Primary vs Secondary Confusion

One of the most frustrating billing errors CMAAs face is incorrect Coordination of Benefits (COB). If the wrong insurance is billed first, the claim gets denied—and fixing it often requires hours of follow-up. Many patients don’t know the proper order of their plans, especially when both spouses carry coverage or when Medicare and Medicaid are involved.

CMAAs need to ask the right questions up front and document coverage order in the EMR accurately. It's also important to check insurance portals for real-time COB listings. Some EMRs include prompts for this—tools like those found in the directory of patient flow tools help streamline updates so you don’t miss payer order flags that stall claims.

| Coordination Element | Primary Insurance | Secondary Insurance |

|---|---|---|

| Who pays first? | Pays initial claim amount based on coverage | Pays remaining amount (if applicable) after primary processes |

| Common examples | Employee’s own insurance, Medicare (in some cases) | Spouse’s plan, Medicaid, supplemental policies |

| Denial risk if confused | Claim rejected for incorrect payer order | Delayed or denied coordination payment |

| What CMAAs must verify | Confirm primary coverage through intake and portals | Check EMR for secondary flags and eligibility |

8. Missing Prior Authorization

CMAAs Are Gatekeepers for Approvals

Many high-cost or specialty services—like MRIs, physical therapy, or durable medical equipment—require prior authorization before care is delivered. If the approval isn’t obtained in time or isn’t linked to the right provider/facility, the claim is automatically denied.

CMAAs often handle this responsibility and must flag services that require pre-approval during scheduling. Failing to do so can delay care, frustrate patients, and cost clinics hundreds of dollars per visit. The best way to avoid this? Set up EMR alerts and maintain a working list of services by insurance plan.

Workflow automation resources in the patient flow tools directory provide CMAAs with checklists and approval tracking methods to ensure nothing slips through the cracks.

9. Poor Communication with Patients

Confusion = Complaints + No-Shows

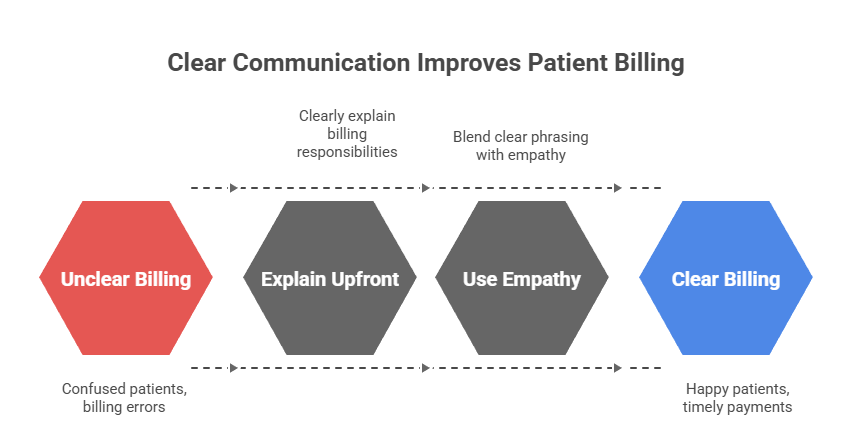

Most billing errors start at the front desk, where CMAAs interact with patients daily. If you don’t explain deductibles, co-insurance, or financial policies clearly, you’ll deal with angry patients, late payments, and appointment cancellations. CMAAs must communicate billing responsibilities upfront—in plain, respectful language.

Empathy is just as important as accuracy. Scripts that blend clear phrasing with emotional intelligence can reduce tension and improve collections. ACMSO’s guide to empathetic patient communication offers real phrases, tone tips, and conflict-resolution tools to use during billing conversations.

10. Incomplete Documentation from Providers

CMAAs Can Flag Gaps Before Submission

Even when CMAAs get everything right, billing still stalls if provider documentation is incomplete. Missing chart notes, unsigned orders, or incorrect encounter forms delay claims, frustrate coders, and slow down reimbursement.

As a CMAA, your role is to spot issues before the claim reaches billing. Are vitals recorded? Is the note signed? Did the provider select a diagnosis? Catching these errors early keeps revenue flowing. EMR fluency is essential—knowing what to check and where.

ACMSO’s complete EMR guide teaches CMAAs how to audit records and communicate with clinical staff using the same tools billers and coders rely on.

How ACMSO Certification Trains You to Avoid These Errors

Real-World Billing Scenarios

The ACMSO Medical Scribe Certification doesn’t just tell you what billing errors exist—it puts you in the driver’s seat to fix them. Each module walks you through denied claims, missing authorizations, duplicate charges, and incorrect provider details, using real documentation examples. You’ll learn to connect intake forms to payer requirements and spot red flags early.

Hands-On EMR & Software Tutorials

You’ll also get interactive tutorials inside EMR and billing systems, where you practice the actual clicks, entries, and audits that front-desk staff manage every day. From NPI verification to authorization flags, ACMSO prepares you to work in real clinical settings—not just passively observe them.

Billing Confidence = Job Confidence

By the time you finish, you’ll know exactly what to check, when to escalate, and how to resolve billing issues before they lead to payment delays. Clinics are now prioritizing CMAAs with billing skills because they reduce risk. ACMSO equips you with these skills through its Directory of CMAA Certification Resources – Everything You Need to Pass, giving you a hiring edge from day one.

How ACMSO Certification Trains You to Prevent Billing Errors

The ACMSO Medical Scribe Certification turns billing theory into hands-on practice. Instead of just listing common mistakes, the course walks you through real denied claims, missing modifiers, credentialing issues, and duplicate charges using authentic documents and patient workflows.

Through guided tutorials in EMR and billing systems, you’ll practice what actually happens at the front desk—intake, NPI lookups, insurance eligibility, and flag resolution. Every task mimics a live setting, preparing you for high-responsibility roles from day one.

You’ll finish the certification confident in your ability to catch and correct billing issues before they stall revenue. Employers value this readiness—and the ACMSO Directory of CMAA Certification Resources ensures you're equipped with every tool to succeed.

Final Thoughts

Being a front-desk medical assistant in 2025 means more than just checking patients in—it means catching billing errors before they snowball into revenue loss or legal trouble. From missing insurance IDs to outdated codes and modifier mishaps, CMAAs are the first checkpoint in the billing chain. Avoiding these common mistakes isn’t about memorizing lists—it’s about learning workflows, tools, and habits that prevent problems before they happen.

The ACMSO Medical Scribe Certification gives you that exact edge. It prepares you with interactive billing scenarios, hands-on EMR tasks, and real-world denial prevention training—all designed to make you not just job-ready, but job-secure. When billing is second nature, your value at the front desk becomes crystal clear.

Frequently Asked Questions

-

One of the most frequent billing mistakes is inputting incorrect patient or insurance information during registration. Even a typo in the policy number or date of birth can cause a claim denial. CMAAs should double-check every field and verify eligibility in real time. Tools like efficient EMR data entry workflows can help ensure accuracy and prevent rework. Clinics rely on CMAAs as the first line of defense in catching these errors before claims ever reach payers.

-

Absolutely. While CMAAs aren’t responsible for full coding, understanding CPT, ICD-10, and HCPCS basics helps you recognize mismatches and flag them before submission. Staying current with annual updates is key. Learning through resources like the 100 most important medical administrative terms ensures CMAAs can confidently assist with billing and avoid delays caused by outdated or missing codes.

-

Duplicate billing often occurs when services are entered more than once or a claim is submitted twice for the same encounter. To avoid this, CMAAs must review EMR charge logs and stay alert to system-generated resubmissions. Familiarity with billing tools is crucial. The interactive medical billing software tutorials offered through ACMSO help CMAAs master workflow checks and build habits that prevent billing redundancies.

-

If prior authorization isn’t on file for a service that requires it, CMAAs must immediately flag it before the appointment, not after. Contact the insurance provider or use EMR-integrated authorization tools to confirm approval. Learning how to manage this process efficiently is part of understanding how to improve patient flow in medical offices, something the top CMAAs consistently get right.

-

Empathy can prevent billing complaints, misunderstandings, and even patient attrition. When explaining charges, CMAAs need to balance accuracy with emotional intelligence. Knowing how to clearly explain co-pays, deductibles, and denials in patient-friendly terms is critical. Scripts and training found in The Art of Empathy: A CMAA’s Guide help assistants stay calm, respectful, and clear—especially when patients are frustrated about billing.