Medical Scribe Workforce Diversity & Demographic Insights (2025 Report)

Medical scribing has quietly evolved into a data-rich, career-accelerating field that touches every specialty and care setting. In 2025, the workforce looks younger, more diverse, and more remote-capable than ever—yet gaps remain across gender, ethnicity, geography, and education. Throughout this report, we pair ground data with practical steps teams can use to recruit, retain, and upskill scribes. For salary baselines and growth pockets, see ACMSO’s salary analysis, the latest remote market report (growth & opportunities), and our interactive salary tool (by state & specialty) for role-specific benchmarking.

1) The 2025 snapshot: who’s entering, who’s advancing

The scribe funnel now pulls from pre-med tracks, allied health, and career changers. Entry roles skew 18–29 with rapid transitions to lead scribe, trainer, or clinical documentation roles. Regions adding telehealth have remote-first pipelines, cross-training scribes into QA and analytics. For ROI-level context, see how scribing impacts hospital revenue with original ACMSO data (revenue analysis) and how accuracy initiatives reduce denials (documentation accuracy annual report). To target hot metros, reference the top cities hiring tracker (interactive report).

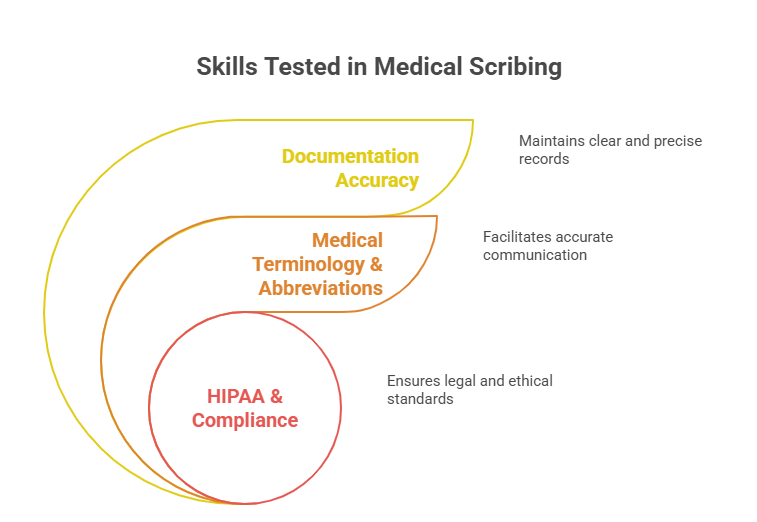

2) Dimensions of diversity that matter for outcomes

Diversity spans gender identity, ethnicity, age, education, geography, certification, and work arrangement. Teams that measure these inputs against productivity, accuracy, and provider satisfaction find clear patterns: mixed-experience teams onboard faster, certified scribes code cleaner, and multilingual teams excel in patient-facing specialties. To price roles fairly, combine the certified vs non-certified pay delta (salary analysis) with state-level medians (salary tool). For remote expansion strategy, map telehealth growth and pay bands to ACMSO’s remote industry report (growth & opportunities).

| Dimension | Segments | Share of Workforce | Median Pay Signal* | Performance/Outcome Notes | Actions & References |

|---|---|---|---|---|---|

| Gender | Women / Men / Non-binary | ~65% / ~33% / ~2% | Neutral overall; role-mix driven | Mixed teams show **higher provider satisfaction** | Accuracy report |

| Ethnicity | Multiracial, Asian, Black, Hispanic, White, Other | Region-dependent | Neutral; impacted by market pay | Language skills correlate with **patient comprehension** | Revenue analysis |

| Age Band | 18–22 / 23–29 / 30–39 / 40+ | 35% / 40% / 18% / 7% | Rises with experience/certification | 23–29 reach **lead roles** fastest | Top cities hiring |

| Education | HS/GED, Some College, Bachelor+, Post-bac | 12% / 38% / 42% / 8% | Bachelor+ earn **8–15%** more | Post-bac track **advances to QA/analyst** | Salary analysis |

| Certification | Certified vs Non-certified | ~56% vs ~44% | Certified earn **10–18%** more | Certified teams record **fewer queries/edits** | Pay delta |

| Work Mode | On-site / Hybrid / Remote | 41% / 27% / 32% | Remote bands vary by state | Remote improves **recruitment speed** | Remote market |

| Geography | Top 20 metros | See ACMSO index | Urban pay **~7–12%** higher | Rural sites leverage **remote pools** | Hiring index |

| Specialty | ED, Ortho, Cardio, IM, Telehealth | ED largest share | Specialty premia vary | Telehealth shows **fastest growth** | Growth report |

| Tenure | 0–12m / 13–24m / 25m+ | 44% / 36% / 20% | Pay steps at 12 & 24 months | Retention spikes with **certification** | Certification impact |

| Language | English + Spanish/Other | ~28% bilingual | Premium in ED & Pediatrics | Better **patient explanation** scores | Comms & accuracy |

| Shift Type | Day / Eve / Night | 54% / 29% / 17% | Nights pay **10–15%** more | Night teams need **longer overlap** | Scheduling data |

| Tools | Epic, Cerner, Athena, Dictation | Epic dominant | Epic skills **raise pay** | Dictation needs **QA loops** | QA practices |

| Career Path | Lead, Trainer, QA, Analyst | Growing share | Premium vs entry roles | Analyst aligns with **rev-cycle ROI** | Revenue study |

| Contract Type | W-2 / Contractor | ~72% / ~28% | Contractors earn **rate premium** | Compliance/QC must **scale** | Contracting trends |

| Tenure Risk | Attrition 0–6m | Elevated | Pay bumps cut risk | Mentorship reduces **early exits** | Step schedule |

| Equity Lens | Pay parity by segment | Monitor quarterly | Corrective bands | Transparency improves **retention** | Salary tool |

*Median pay signal = directional only. For exact figures, use ACMSO’s interactive salary comparison and certified vs non-certified analysis.

3) Gender & ethnicity: closing real-world gaps

Organizations that track pay parity quarterly, segment by role/specialty, and publish ranges see faster promotion velocity for under-represented groups. Tie equity tactics to billable quality—documentation accuracy and provider time saved—so DEI gains match financial outcomes. Use the revenue impact lens (hospital revenue analysis) and the accuracy annual (documentation report) to link fairness to ROI. Pay calibration should reference both state medians (salary tool) and certification differentials (salary analysis).

4) Age, education & certification: building the pipeline

Early-career scribes progress fastest when coached deliberately in the first 90 days. Pair micro-training with templated feedback and a step schedule that rewards mastery. Certified scribes consistently deliver cleaner charts and lower edit rates, which raises provider satisfaction and accelerates reimbursements. To tune the pipeline, compare your local results to ACMSO’s remote growth (industry report) and city demand index (top cities). Align promotion criteria to accuracy metrics (annual report) and revenue lift (original data).

5) Geography & modality: remote is the new equalizer

Remote hiring widens access to rural and multilingual talent, compresses start times, and helps balance shift coverage. Hybrid models keep complex subspecialties on-site while routing follow-ups or low-acuity notes to remote teams. Compensation should float with state medians (interactive salary tool) and include differentials for nights, bilingual capacity, and Epic proficiency. Use ACMSO’s remote market playbook (growth & opportunities) to structure W-2 vs contractor mixes without sacrificing QA (documentation accuracy).

ACMSO Quick Poll: Which factor most improves your scribe outcomes in 90 days?

6) Execution playbook: from insight to staffing impact

Standardize pay, publish ranges, and tie incentives to accuracy, throughput, and provider NPS. Build a diversity dashboard that compares certified vs non-certified output (pay/certification delta), remote vs on-site error rates (accuracy annual), and revenue lift by team (revenue analysis). Calibrate recruiting to city demand (top cities) and adjust differentials with state medians (salary tool). Use ACMSO’s remote growth guidance (industry report) to expand coverage windows sustainably.

FAQs

-

Structured coaching in the first 4–6 weeks. Pair shadowing, templated notes, and weekly QA reviews. Add a modest step raise at 90 days to lock retention. For standards and ROI references, see ACMSO’s accuracy annual and revenue impact study.

-

Yes. Certified roles show 10–18% pay advantages and lower edit rates across specialties. Certification also accelerates promotion to lead/trainer/QA. Validate with ACMSO’s salary analysis and align local ladders to measurable accuracy targets (annual report).

-

Use state medians as guardrails, then add differentials for nights, bilingual capability, Epic proficiency, and volume tier. Start with ACMSO’s interactive salary tool, layer your QA outcomes, and sync offers with the remote growth outlook (industry report).

-

Metros expanding ED and telehealth lines—track them via ACMSO’s top cities report. Pair this with revenue modeling (original data) to prioritize high-yield deployments.

-

Publish transparent ranges, invest in bilingual training, and link bonuses to accuracy + provider NPS. Embed mentorship for 0–6 month hires and subsidize certification to close gaps. Calibrate with ACMSO’s salary analysis and accuracy framework (annual report).