Annual Medical Scribe Employment Report: Trends & Future Predictions

Medical scribing in 2025 is larger, more remote, and more specialized than ever. Demand tracks with telehealth scale, EHR complexity, and revenue-cycle pressure. Markets paying a premium for certified talent mirror findings in ACMSO’s salary analysis, while remote expansion follows the industry growth map (remote report). Hiring hotspots are visible in the interactive city index (top cities), and compensation planning is faster with the state/specialty tool (salary tool). For CFO buy-in, link headcount to documentation quality and revenue impact (accuracy annual, revenue analysis).

1) 2025 hiring snapshot: demand, pipelines, promotions

Provider burnout and E/M guideline shifts continue to fuel hiring. Entry pathways now include pre-med, allied health, and career-switchers trained on Epic, Cerner, and dictation QA. Certified scribes advance into lead, trainer, QA, and analyst roles faster; the pay delta is detailed in ACMSO’s certified vs non-certified. Growth mirrors remote opportunity by service line (industry report), with hotspots in the city hiring index (interactive report). Tie staffing plans to accuracy metrics (annual report) and model revenue with the impact study (original data).

2) What’s driving growth (and where shortages will persist)

Three forces dominate: telehealth normalization, EHR automation that still needs human QA, and denial pressure demanding cleaner documentation. Remote models widen access to bilingual and night-shift talent, while ED and subspecialty tele-clinics pull ahead. Use the salary tool to price differentials by state (interactive tool), compare certified premiums (salary delta), and map remote-viable roles (remote growth). For CFOs, the accuracy annual connects training to edit-rate reductions (documentation accuracy) and the revenue analysis links capacity to cash acceleration (impact study).

| Signal | 2025 Trend | Hiring Impact | What to Do |

|---|---|---|---|

| Telehealth volume | ↑↑ | More remote seats | Use remote report |

| Certified premium | 10–18% | Retention lever | Benchmark via salary delta |

| City hotspots | Expanding | Faster fills | Target with city index |

| State medians | Diverging | Offer variance | Price with salary tool |

| Epic proficiency | Premium | Higher wages | Train; track QA in accuracy annual |

| Night coverage | Undersupplied | Pay diffs | Add differentials; remote nights |

| Bilingual hires | Rising | Patient comms | Prioritize ED/peds teams |

| QA automation | Partial | Human review | Codify QA loops |

| Denial pressure | High | Cleaner notes | Adopt accuracy practices |

| Lead/Trainer roles | Growing | Internal mobility | Create ladders |

| Analyst roles | Emerging | Rev-cycle wins | Link to revenue study |

| Contractor mix | Wider | Flex capacity | Blend with W-2 |

| Attrition 0–6m | Elevated | Onboarding risk | Mentor + step raise |

| Rural coverage | Remote-led | Broader access | Remote playbook |

| Specialty demand | ED, Ortho, Tele-IM | Targeted hiring | Pay tiers by specialty |

| Promotion velocity | Faster for cert | Career stickiness | Subsidize certification |

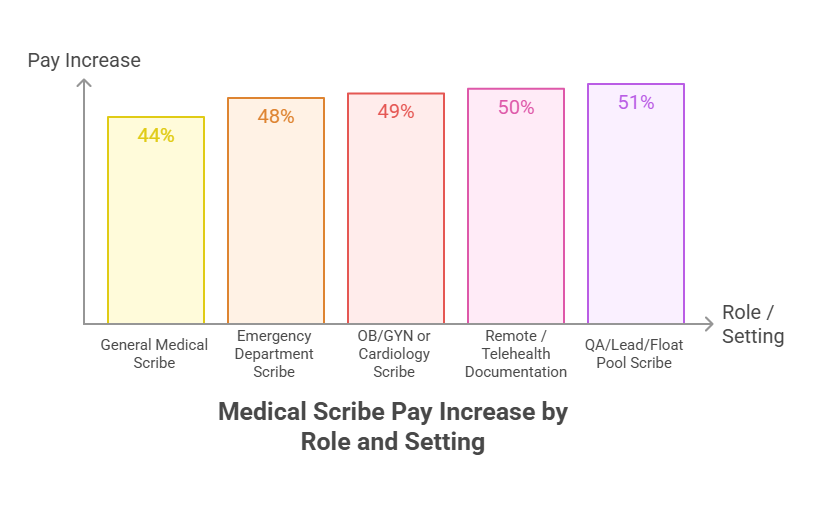

3) Compensation: setting ranges that actually hire (and keep) talent

Build ranges with state medians, then layer differentials for nights, bilingual skill, Epic, QA output, and leadship scope. Start with ACMSO’s salary tool (state & specialty), validate the certification premium (salary analysis), and align incentives to accuracy KPIs (annual report). Tie bonuses to provider time saved and denial prevention using metrics from the revenue study (impact analysis).

4) Staffing models: on-site, hybrid, fully remote

Remote scribing is now a core modality, not a pilot. Use remote for follow-ups, low-acuity clinics, and after-hours, while keeping complex subspecialties on-site/hybrid. Blend W-2 and contractor talent to cover seasonality and surge clinics, following the remote growth guidance (industry report). Keep QA centralized with templated feedback from the accuracy annual (documentation framework) and price roles fairly with the salary tool (state medians).

5) 12-month execution plan: capacity you can defend to finance

Phase 1 (0–30 days): lock ranges, publish steps, and open remote nights. Phase 2 (31–90): certify a pilot cohort and hard-wire QA loops; measure edit-rate drop using the accuracy annual framework (documentation accuracy). Phase 3 (90–180): promote leads/trainers, add analyst roles for rev-cycle, and expand to hot metros (city index). Validate ROI with the revenue impact model (original analysis) and recalibrate pay with the salary tool (interactive).

ACMSO Quick Poll: Where will your next 10 hires come from?

6) Forecast to 2028: what changes, what stays true

Remote remains structural, with nights and bilingual roles carrying premiums. Certification stays the fastest lever for quality, promotion, and retention; the salary delta persists (certified vs non-certified). City hotspots expand, but state variance in pay widens (salary tool). Analyst and rev-cycle roles grow as EHR automation offloads low-value clicks but still needs human QA (accuracy annual). Revenue-linked staffing becomes standard finance practice (impact study).

FAQs

-

Open multi-state remote reqs first, then layer night and bilingual differentials. Use ACMSO’s city index (top cities) and state medians (salary tool) to price. Backstop quality with QA templates (accuracy annual).

-

Tie staffing to denial prevention, provider time saved, and faster cash using ACMSO’s revenue analysis (impact study). Show edit-rate drops using the accuracy framework (annual report).

-

Yes—certified scribes earn 10–18% more, achieve lower edit rates, and promote faster. Validate locally against ACMSO’s salary analysis (cert vs non-cert) and documentation outcomes (accuracy annual).

-

ED tele-coverage, orthopedics, and virtual IM. Target ACMSO’s hot metros (city index) and scale remote after-hours per the industry report (remote growth).

-

Weak first-90-days coaching. Fix it with shadowing, weekly QA reviews, and a 90-day step raise. Track progress in the accuracy annual (documentation framework) and calibrate pay via the salary tool (state/specialty).