Medical Office Budgeting Tools Directory (CMAA’s Top Picks)

Medical offices—whether solo practices or midsize clinics—are under increasing pressure to maximize profitability while staying compliant. Rising labor costs, variable insurance reimbursements, and supply chain unpredictability demand tighter financial control. Without a proper budgeting tool, even small discrepancies can spiral into systemic shortfalls. Yet many clinics still rely on outdated spreadsheets or manual record-keeping, leading to overspending, missed benchmarks, and poor forecasting. Financial visibility is no longer a bonus—it’s a requirement.

This is where modern budgeting software transforms medical administration. By automating expense tracking, predicting cash flow trends, and syncing with electronic health records (EHR), these tools enable practices to stay lean without compromising care. For medical scribes and administrators, especially those managing multiple specialties or departments, the right budgeting platform is a force multiplier. Whether you're handling vendor contracts, staff payroll, or capital equipment purchases, software-assisted visibility drives smarter, faster decisions—and protects thin margins in a volatile healthcare economy.

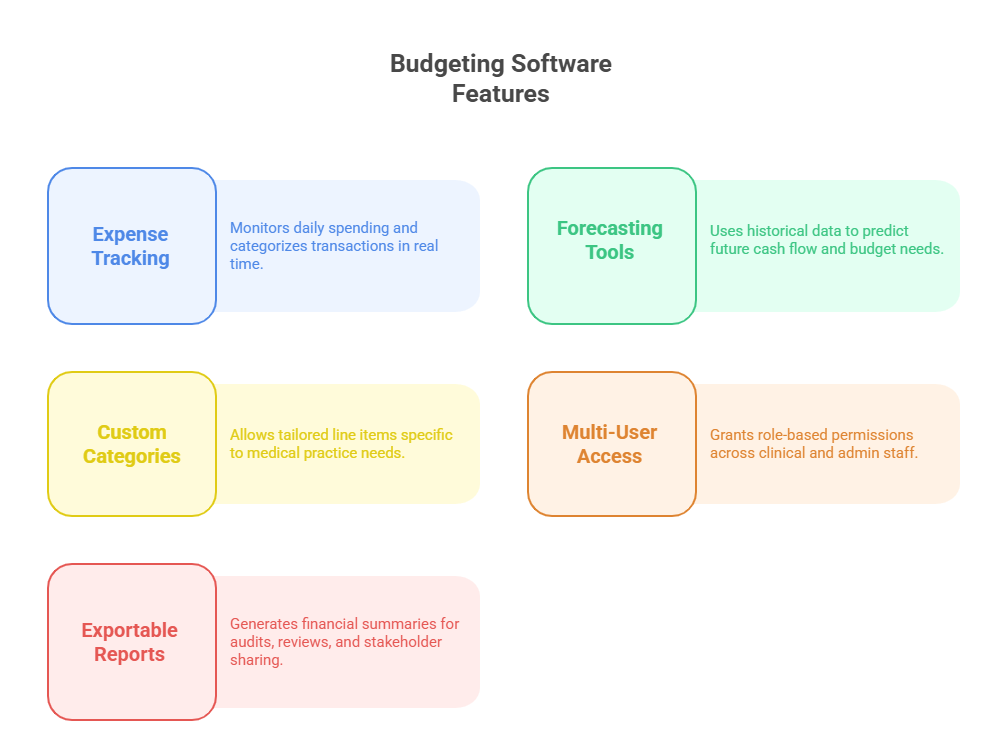

Must-Have Features in Budgeting Software

Effective budgeting tools for medical offices must go far beyond spreadsheets and checkbook-style trackers. Today’s practices operate in a fast-moving healthcare economy, where every dollar must be accounted for, forecasted, and justified. Software must deliver precision, automation, and usability across roles—from the front desk to billing and compliance.

Expense Tracking & Forecasting

At the core of any robust budgeting system is its ability to track daily expenses in real time and project costs accurately. Clinical practices deal with fluctuating variables—medical supplies, lab fees, utility costs, temporary staffing—that can derail budgets fast. Tools like QuickBooks and Kareo automate this process by categorizing expenses and flagging anomalies as they occur.

What separates medical-grade tools from general apps is intelligent forecasting. The best software learns from past patterns—seasonal flu surges, insurance payout delays, or vendor cost hikes—and translates that into predictive dashboards. These insights help administrators plan for high-expense quarters or proactively cut non-essential spending without compromising care delivery.

Custom Budget Categories

Generic line items don’t work in specialized care environments. Budgeting tools tailored to medical settings let users build custom expense categories for surgical disposables, telehealth equipment, continuing education, or even malpractice insurance premiums.

Granular categorization matters for financial audits, tax filing, and cost-benefit reviews on new equipment or staff hires. It’s not just about where money is going, but why—and whether that spend aligns with outcomes and growth goals. Platforms like Excel can be customized, but solutions like Wave or Kareo include pre-set medical categories that speed up this process significantly.

Multi-User Permissions & Reporting

Administrative roles vary widely across healthcare teams. Budgeting software must allow role-based access—so receptionists don’t edit payroll, but finance managers can download reports or modify high-level budget structures. Multi-user permissions also ensure accountability and prevent errors from accidental edits or deletions.

Equally important is built-in reporting. Whether you're sharing quarterly forecasts with department heads or generating compliance-ready financial statements, tools should output clean, exportable reports. Some apps include real-time dashboards, while others allow scheduled email reports to keep physicians, owners, and managers aligned without logging into multiple systems.

Best Free and Paid Budgeting Tools Compared

The budgeting needs of medical offices vary drastically depending on their size, specialties, and operational complexity. Whether you're a solo practitioner managing expenses yourself or a multi-location clinic with a dedicated admin team, the right tool can eliminate financial blind spots and accelerate decision-making. Below is a breakdown of top free and paid tools and how they align with real-world clinical needs.

Kareo, QuickBooks, Wave, Excel

Kareo: Built specifically for healthcare, Kareo integrates budgeting with medical billing, appointment scheduling, and clinical charting. Its financial tools are designed around revenue cycle management, helping administrators connect expenses with collections and claims performance. While it’s not free, the healthcare-specific design gives it an edge over general finance apps.

QuickBooks: Ideal for mid-size practices with a part-time accountant or bookkeeper. It offers customizable categories, real-time bank sync, payroll tools, and strong third-party app integrations. QuickBooks lacks EHR-specific functions, but its maturity and support ecosystem make it a dominant choice.

Wave: A powerful free option for small practices or startups. Wave includes invoicing, receipt scanning, and basic payroll (for a fee). It doesn’t integrate with medical billing platforms directly, but it’s a zero-cost entry into structured financial control.

Excel: Still widely used, especially among solo practitioners or clinical administrators managing multiple projects. Excel’s strength is flexibility—you can create templates tailored to your reporting needs. But it lacks automation, error tracking, and collaboration controls.

Integration with Billing & EHR Systems

In healthcare, financial tools can’t operate in isolation. Seamless integration with billing systems and EHR platforms turns budgeting software into a strategic asset. When Kareo links budget reports with patient billing, administrators can trace revenue sources, monitor denied claims, and pinpoint exactly where cash flow bottlenecks originate.

QuickBooks and Wave can sync with third-party billing software via plugins or APIs. However, medical offices often hit integration walls that result in double data entry or mismatched line items. That’s why choosing tools that are purpose-built or EHR-compatible saves more than time—it prevents reporting discrepancies that can affect audits, reimbursement tracking, and vendor negotiations.

When evaluating any financial tool, check if it natively connects with:

Your medical billing platform

Your EHR/EMR system

Payroll processors

Inventory control tools

Without this integration, even the most feature-rich software becomes a silo—and silos in clinical administration lead to expensive inefficiencies and preventable errors.

| Tool | Type | Healthcare Compatibility | Integrations | Best Use Case |

|---|---|---|---|---|

| Kareo | Paid | Built for medical offices | EHR, billing, scheduling | End-to-end practice financial management |

| QuickBooks | Paid | General-purpose, not healthcare-specific | Banking, payroll, third-party apps | Midsize clinics with in-house accountants |

| Wave | Free | Basic; not EHR-integrated | Bank feeds, Stripe, receipts | Startups and solo practitioners |

| Excel | Free (Manual) | Highly flexible but manual | None by default (customizable) | Clinics needing custom reports or simple templates |

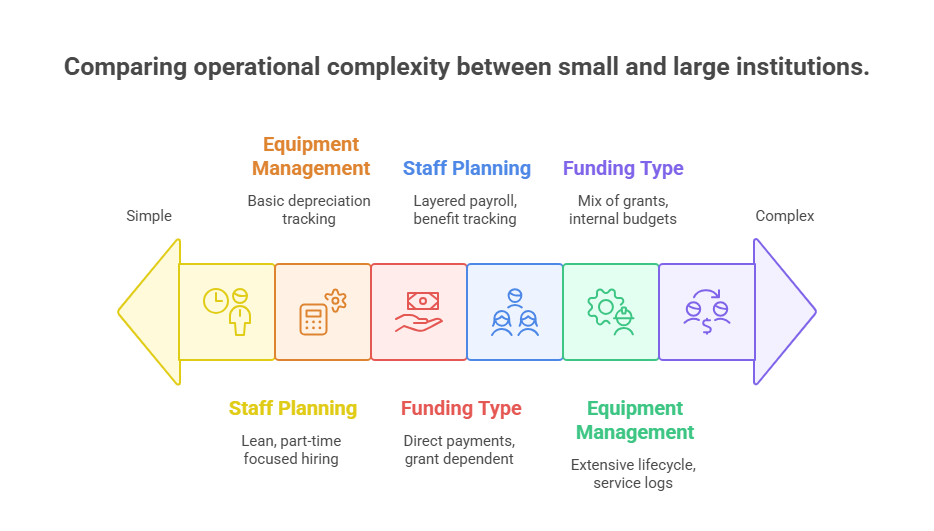

Budgeting for Small Clinics vs Large Institutions

The scale of your medical office radically shifts your budgeting approach. While small clinics prioritize cash conservation and flexibility, large institutions require standardization, cost-center reporting, and long-term capital forecasting. Effective budgeting software must adapt to both—supporting lean teams while also handling the complexity of enterprise operations.

Staff Cost Planning

In small clinics, labor is often the single largest recurring expense. With fewer staff members, any changes—like adding a part-time nurse or outsourcing billing—must be budgeted with high precision. Tools like Wave or Excel allow flexible labor cost entries, but they require manual updates to stay current.

Large institutions, on the other hand, manage multi-layered staffing structures: physicians, nurse practitioners, administrative aides, IT staff, janitorial teams. Here, staff cost planning requires role-based cost allocation, benefits tracking, and overtime forecasting. QuickBooks or enterprise-level tools with HR integrations make it easier to align payroll with budgeted headcounts.

Equipment Depreciation & Maintenance

Smaller practices may only need basic medical equipment: diagnostic tools, sterilization units, or EHR workstations. But even for minimal setups, equipment depreciation must be tracked annually, especially for tax purposes or capital reinvestment planning. Budgeting tools that allow asset tagging and maintenance logs provide long-term clarity.

Larger institutions juggle dozens—or hundreds—of assets, including imaging machines, surgical equipment, mobile carts, and more. Without proper depreciation tracking and scheduled servicing budgets, replacement cycles become reactive rather than proactive, which impacts service quality and emergency costs.

Tools that support fixed asset modules or integrations with CMMS (computerized maintenance management systems) are especially useful for large organizations.

Grant vs Out-of-Pocket Expenditure

For small practices, grants from government agencies or healthcare alliances can significantly offset tech adoption or training costs. Budgeting software must distinguish between grant-funded expenses and direct out-of-pocket spend, so clinics stay compliant with reporting requirements and avoid misuse.

In contrast, large institutions often rely on a mix of:

Internal capital budgeting

Departmental spending caps

Competitive grants or research funds

This necessitates layered budgeting capabilities, where funding source, spend category, and approval chain are all tracked. Mismanagement here not only wastes money—it risks legal exposure or grant ineligibility.

Regardless of size, the key lies in choosing tools that allow visibility into funding streams, enforce spending rules, and adapt to institutional complexity without overwhelming smaller users.

Mistakes That Lead to Financial Waste

Even the most well-meaning medical offices lose thousands each year to budgeting missteps. These mistakes don’t always come from big-ticket purchases—in fact, small, recurring oversights often cause the most damage. Identifying and eliminating these habits can immediately improve cash flow, operational clarity, and financial compliance.

Overbuying Inventory

It’s common for clinics to order supplies in bulk for the sake of convenience or supposed cost savings. But without proper usage tracking, overordering leads to:

Expired medications or sterile tools

Unused backroom stock

Missed reorder thresholds for actual critical items

Modern budgeting tools that sync with inventory systems can prevent this. They alert you to reorder levels, usage spikes, and historical purchasing patterns. Unfortunately, many clinics still rely on gut decisions, which creates a disconnect between actual need and budget allocation.

Worse, idle inventory ties up capital that could be invested in patient care improvements, software upgrades, or staff training.

Ignoring Software Subscription Costs

SaaS costs often hide in plain sight. Practices may sign up for multiple platforms—EHR add-ons, billing APIs, analytics dashboards—without consolidating or reviewing their cumulative monthly spend. Each $30 or $70 subscription feels small until you’re spending $1,200+ per month on underused tools.

Budgeting platforms with vendor management features or recurring cost tracking can flag these inefficiencies. Some even allow contract linking or renewal reminders so admins can cancel or renegotiate terms before automatic renewals hit.

A regular quarterly review of software subscriptions is essential. Clinics must ask:

Is this tool still aligned with our workflow?

Is there overlap between platforms?

Can we consolidate features under one vendor?

Without these questions and corresponding budget alerts, even lean practices hemorrhage money from "death by subscription."

How to Build a Quarterly Budgeting Cycle

Quarterly budgeting offers the right balance between flexibility and oversight for medical offices. It allows clinics to pivot with real-world developments—new reimbursements, staffing shifts, or vendor price changes—without locking them into rigid annual projections. A well-run quarterly cycle ensures visibility, accountability, and proactive planning at every stage.

Using Past Trends for Forecasting

Smart budgeting isn’t guessing—it’s recognizing repeatable financial behaviors. Start each quarter by reviewing:

Past quarter’s actual spend vs projections

Reimbursement patterns across insurers

Season-specific cost spikes (e.g., flu testing or allergy meds)

Tools like QuickBooks and Kareo allow you to compare periods and spot these trends graphically. If your clinic consistently overspends on overtime or underestimates supply needs during peak flu season, that insight becomes a forecasting input—not just a hindsight correction.

This trend-based budgeting ensures resource readiness and helps justify higher budgets where necessary—like preventive purchases or pre-negotiated service contracts.

Mid-Cycle Adjustments

No budget survives contact with reality unchanged. From staff turnover to billing platform outages, medical practices need flexibility baked into their planning process. That’s why mid-cycle reviews are non-negotiable.

At the midpoint of each quarter:

Evaluate actuals vs targets across categories

Reallocate unused budget lines (e.g., paused equipment purchases)

Respond to underfunded emergencies (e.g., urgent IT support or clinic repairs)

Your budgeting software should support real-time line-item editing and comments so changes are transparent and traceable. Avoid retroactive justifications—adjustments should always be forward-looking and documented with rationale.

Ultimately, a quarterly cycle is about rhythm: review, project, adjust, repeat. That cadence brings financial control to frontline decision-makers without burdening them with excessive admin.

| Stage | Function | Recommended Actions | Why It Matters |

|---|---|---|---|

| Start of Quarter | Planning & Forecasting | Review past trends, set new expense forecasts, align with goals | Ensures realistic budgeting aligned with clinical and business needs |

| Mid-Quarter Review | Performance Check | Compare actuals to projected spend, adjust budget lines | Allows early intervention and dynamic reallocation of resources |

| Final Month Wrap-Up | Closeout & Prep | Lock actuals, finalize budget report, begin next cycle planning | Prevents carryover errors and improves upcoming cycle accuracy |

| Continuous Feedback | Real-Time Optimization | Use software tools for live alerts, staff feedback, and variance tracking | Drives financial agility and long-term sustainability |

Medical Scribe Certification by ACMSO: Role in Financial Admin Excellence

Financial precision in medical offices doesn’t come from software alone—it comes from trained professionals who understand how clinical operations connect to budgeting outcomes. The Medical Scribe Certification by ACMSO equips healthcare staff with not just documentation skills but also the financial and administrative fluency that clinics urgently need.

Certified scribes are trained to track clinical workflows, which translates directly into cost-efficiency. By documenting accurately in real time, they reduce coding errors, support faster billing, and eliminate duplicate testing—each of which reduces financial waste. But the certification goes further: scribes gain an understanding of how scheduling, EHR entries, and vendor communications influence budget integrity.

In small and mid-sized practices, certified medical scribes often support cross-functional roles, including reporting tasks, insurance pre-approvals, or ordering supplies. A scribe trained via ACMSO’s program can input data into budgeting tools, run cost reports, and assist with cycle planning—making them indispensable to administrators who juggle financial oversight with clinical demands.

In fast-paced healthcare environments, administrative roles need agility and accuracy. The Medical Scribe Certification by ACMSO ensures that staff can contribute not just clinically, but also financially—helping clinics stay lean, audit-ready, and scalable.

Frequently Asked Questions

-

Real-time expense tracking is the most critical feature for any medical practice. It allows administrators to monitor cash flow as it happens, spot unusual spending patterns, and make quick adjustments. In fast-paced clinics, a delayed expense report can cause overspending before anyone notices. Tools like Kareo and QuickBooks automatically categorize transactions and provide visual dashboards to prevent budget blind spots. With tight margins in outpatient care, especially for small or rural clinics, being reactive isn't an option. Real-time visibility means decisions can be proactive, timely, and aligned with both clinical and financial performance goals.

-

Free tools can work—if the clinic’s operations are small and simple. Wave offers automated transaction tracking, invoice management, and basic reports, making it a solid choice for solo practitioners. Excel is still widely used for its flexibility, especially when customized with templates and formulas. But both tools lack robust integration with medical billing systems or EHR platforms. As a practice grows, the absence of automation, real-time alerts, or team collaboration features creates risk. For serious financial oversight, investing in a purpose-built platform ensures better security, audit-readiness, and cost categorization relevant to healthcare.

-

Quarterly budgeting cycles strike the best balance between adaptability and structure. Reviewing your budget every three months allows practices to adjust for payer delays, seasonal patient volume, or unexpected equipment repairs. Monthly reviews may be too granular for some, while annual reviews are too infrequent to catch mid-year shifts. Software with trend analytics and forecasting modules makes quarterly adjustments easy to implement. Clinics can use past data to refine projections, avoid overspending, and redistribute budget lines based on evolving clinical needs. This rhythm helps clinics stay agile in a rapidly changing healthcare environment.

-

Yes—but indirectly. Budgeting software isn’t a billing system, but when it integrates with EHRs and RCM (revenue cycle management) tools, it can help administrators identify where claim errors are costing the most money. For example, if denials spike in Q2, your expense-to-revenue ratio will be off. This insight prompts administrators to audit claim submissions or retrain staff. Some platforms let you assign notes to irregular transactions or automate alerts when revenue dips below forecast. Over time, this data closes the feedback loop between documentation, billing, and budget accuracy—improving both compliance and reimbursement rates.

-

Small clinics can empower their current staff—particularly medical scribes or front-desk administrators—by training them in basic financial reporting and platform usage. With the Medical Scribe Certification by ACMSO, staff gain cross-functional skills that support both documentation and financial workflows. Budgeting tools like Wave or QuickBooks allow role-based access so different staff can update expenses, categorize costs, or run reports without needing full accounting expertise. Clinics should set up automated alerts, recurring reports, and calendar-based budget check-ins to maintain control. With proper workflows, a lean team can still run a highly efficient budgeting operation.

-

Many clinics waste thousands per year on unused or overlapping software tools. Subscriptions for billing add-ons, analytics tools, AI schedulers, and EHR plug-ins often renew automatically. Without centralized tracking, these costs balloon unnoticed. Budgeting platforms with vendor tracking features allow you to monitor active subscriptions, flag renewals, and consolidate vendors where possible. Clinics should conduct a subscription audit every quarter to assess usage, cost vs value, and redundancy. Ignoring this can result in "silent drain" spending—where funds that could go to patient care or staff bonuses are lost to forgotten auto-renewals.

-

Absolutely. Larger institutions require features like departmental budgeting, multi-location support, and advanced reporting that small-scale platforms can’t handle. They need fixed asset tracking, role-based access for dozens of users, and robust integration with HR, billing, and EHR systems. On the other hand, solo clinics benefit from simplicity, quick setup, and low overhead. Choosing the wrong scale tool—like giving a solo doctor enterprise software—can lead to unnecessary complexity and wasted time. The key is finding a platform that matches your operation’s size, structure, and goals—not just the one with the most features.

Conclusion

Budgeting in a medical office isn’t just about crunching numbers—it’s about maintaining operational clarity, financial sustainability, and patient care excellence. Whether you're running a solo clinic or managing a multi-site institution, the right tools empower you to forecast accurately, reduce waste, and respond to economic volatility without sacrificing efficiency.

Pairing smart budgeting software with trained administrative professionals, such as those certified through the Medical Scribe Certification by ACMSO, ensures that financial decisions are informed, timely, and aligned with clinical priorities. With rising costs and shrinking margins, clinics that embrace data-driven financial oversight will be the ones that grow—resilient, audit-ready, and future-proof.

Poll: Which feature matters most to you in a medical office budgeting tool?